Also, the five counties with the highest audit rates are all predominantly African American, rural counties in the Deep South. These days, the top-earning 1% of taxpayers are audited at about the same rate as those who claim the earned income tax credit (EITC), a group that has an average household income of $20,000 a year.Ī recent analysis found that a rural county in the Mississippi Delta was the highest-audited county in America, despite the fact that more than a third of its mostly African-American population is below the poverty line. The IRS audits taxpayers with household income between $50,000 and $100,000 the least.Īs ProPublica has reported, the IRS has seen its budget slashed year over year, and its ability to audit the wealthy and corporations has also suffered. Typically it does not look back further than six years. However, the agency can look further back if it identifies a major error. The IRS generally includes the past three filing years in a tax audit. You might also hear from the IRS via a tax notice, which is usually less serious and could be for any number of reasons, like verifying your identity, increasing or decreasing your tax return amount.

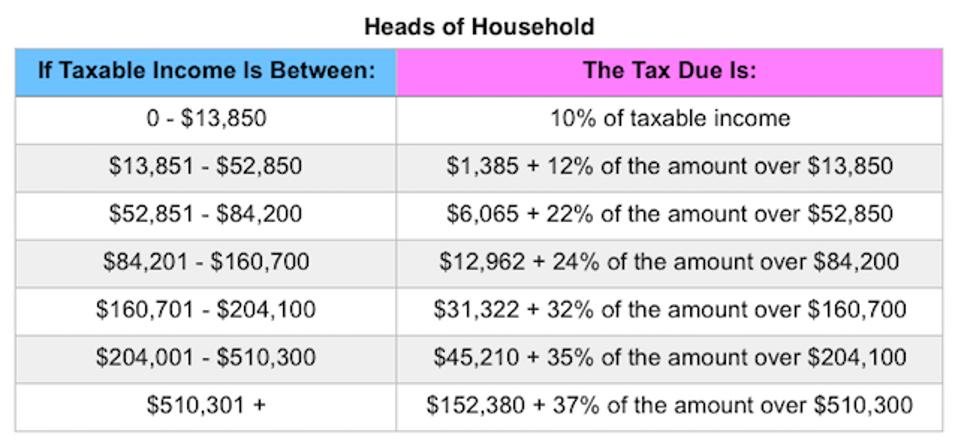

If you’re being audited, you will find out via mail - never over the phone. Sometimes, you’ll be chosen randomly, but usually something or someone will make your return stand out, and it will be flagged for an audit. What is an IRS tax audit?Īn IRS audit is a review of a person’s tax filing by an IRS official to make sure everything was done correctly. That means they’ll fall into the 12% bracket. If they only take the standard $12,200 deduction, they will have a taxable income of roughly $20,000. Before claiming the standard deduction, make sure you understand the rules - for example, you can’t deduct home mortgage interest if you are also claiming the standard deduction.Įxample: Let’s take a single person whose only income is from their salary of $32,000. The most-used tax deduction is the standard deduction, which is a no-questions-asked amount that you can subtract from your income, lowering the total amount of taxes you have to pay. See the chart above to find out where it places you. Once you’ve determined your total income, you can generally subtract any deductions to arrive at your taxable income.

What that really means is the amount you get taxed progresses with the amount of money you make - even within the tax brackets outlined above.Įxample: Let’s say as a single filer, you bring in a taxable income of $20,000. has what’s called a progressive tax system.

If you look at the table above, you might assume that you are simply taxed at one flat rate for all of your income.

0 kommentar(er)

0 kommentar(er)